The trouble of a large Chinese real estate company comes at a time when Beijing is beating private companies and strengthening economic supervision. At present, the fate of Evergrande is difficult to tell. Some scholars pointed out that regardless of whether Beijing rescues Evergrande, China’s economy will be hit hard and economic growth will continue to slow down.

[Start LINE push broadcast] Daily important news notification

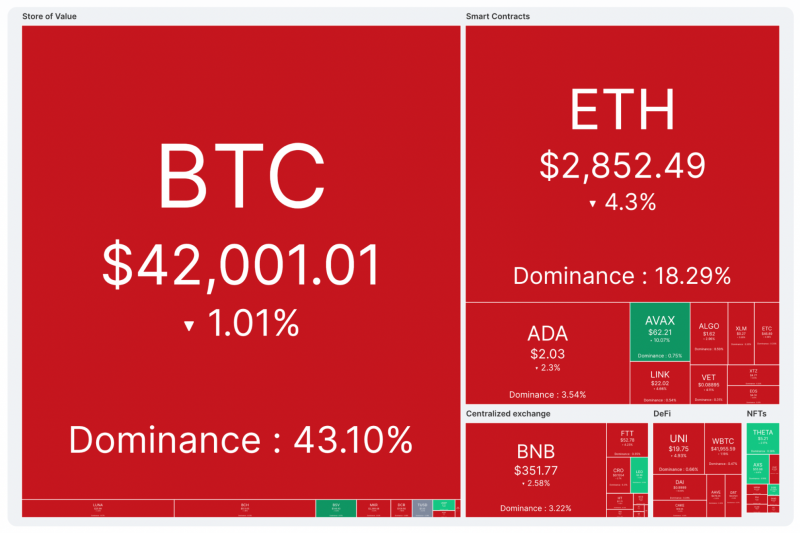

The debt-ridden Chinese real estate giant Evergrande Group is in deep trouble, causing the industry to worry about the possible spread of the crisis, worrying that it may severely damage the economic growth of China, the world’s second largest economy, and affect the international supply chain, thereby seriously disrupting the global economy .

It is generally believed that despite Evergrande’s debt of 300 billion US dollars, the Chinese government will still rescue it in some way. Evergrande is different from Lehman Brothers in the US during the global financial crisis in 2008. Evergrande is “too big to fail”.

The main reason the ruling CCP will pull Evergrande is to ensure the stability it needs to hold power. If anything is too big to fall, it is the CCP itself.

Evergrande’s success is based on China’s development model

In terms of sales volume, Evergrande is the second largest real estate developer in China. Its early success is based on China’s amazing urbanization project in the past 20 years-the world’s largest urbanization project.

The surge in housing demand means that real estate companies backed by local governments can make money efficiently. Lease of land to real estate developers is the main way to make money.

The central government strongly encourages this large-scale expansion. One of the reasons is that a large part of China’s economic growth is based on real estate, which accounts for 29% of GDP.

However, once an industry overheats, the CCP will intervene in order to stabilize it. Recently, in its efforts to continue to emphasize economic development as the center of rejuvenation, the CCP has introduced more measures to strengthen economic control.

As a real estate empire built on rapid expansion and massive borrowing, Evergrande uses a cash flow model that is similar to a Ponzi scheme in the eyes of many people. Building for sale. At present, Evergrande’s life is hanging by a thread.

“China’s economy will be hit hard”

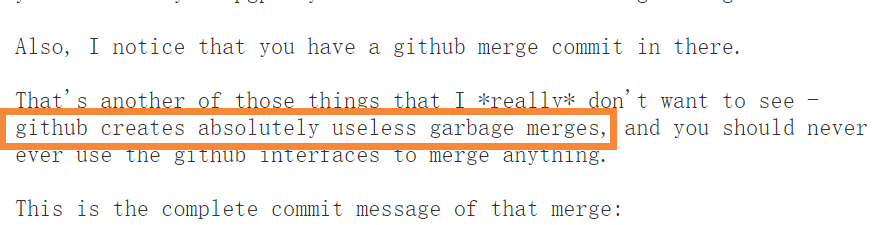

Ho-fung Hung, a professor of political economy at Johns Hopkins University, said that Beijing’s tightening of its control over the Chinese economy is a “North Koreanization” approach with unpredictable consequences.

In an interview with Deutsche Welle, he said that if the CCP does not rescue, Evergrande will collapse, which may lead to economic chaos and social unrest; if rescued in a certain way, there will be many others who are in the same or worse situation. Big developers, and the government is obviously unable to rescue everyone. “Therefore, no matter how it develops, it will inevitably hurt the economy. China’s old growth model, which relies heavily on debt-financed fixed-asset investment, is unsustainable.”

Kong Haofeng believes that given that the transformation of the Chinese Communist Party’s economy to high-tech, private consumption-driven growth is far from complete, he expects that China’s economic growth will continue to slow down, with a deeper, broader and longer duration.

恒大风暴》Too big to fail?负债3000亿美元,救与不救间,北京千万难

一家中国大型房地产公司的麻烦发生在北京击败私营公司并加强经济监管之际。目前,恒大的命运还很难说。有学者指出,无论北京是否救助恒大,中国经济都将受到重创,经济增长将继续放缓。

【开始LINE推送】每日重要新闻通知

负债累累的中国房地产巨头恒大集团深陷困境,引发业内担忧危机可能蔓延,担心可能严重损害全球第二大经济体中国的经济增长,并影响国际供应链,从而严重扰乱全球经济。

外界普遍认为,尽管恒大负债3000亿美元,但中国政府仍会以某种方式救助它。恒大与2008年全球金融危机期间的美国雷曼兄弟不同,恒大“大而不能倒”。

执政的中共拉动恒大的主要原因是为了确保其掌权所需的稳定性。如果说有什么东西大而不能倒,那就是中共本身。

恒大的成功基于中国的发展模式

就销售额而言,恒大是中国第二大房地产开发商。它的早期成功建立在中国过去20年惊人的城市化工程——世界上最大的城市化工程的基础上。

住房需求的激增意味着由地方政府支持的房地产公司可以高效赚钱。向房地产开发商出租土地是主要的赚钱方式。

中央政府大力鼓励这种大规模扩张。原因之一是中国经济增长的很大一部分是基于房地产,占GDP的29%。

但是,一旦一个行业过热,中共就会出手干预,以求稳定。近期,为了继续强调以经济发展为振兴重心,中共出台了更多措施加强经济调控。

作为一个建立在快速扩张和巨额借贷之上的房地产帝国,恒大使用的现金流模型在很多人眼中类似于庞氏骗局。出售建筑物。目前,恒大的命悬一线。

“中国经济将遭受重创”

约翰霍普金斯大学政治经济学教授洪浩峰表示,北京加强对中国经济的控制是一种“朝鲜化”的做法,后果不可预测。

他在接受德国之声采访时表示,如果中共不救,恒大就会倒闭,可能导致经济混乱和社会动荡;如果以某种方式获救,将会有许多其他人处于相同或更糟的境地。大开发商,政府显然也救不了大家。 “因此,无论如何发展,都不可避免地会伤害经济。中国严重依赖债务融资固定资产投资的旧增长模式是不可持续的。”

孔浩峰认为,鉴于中国共产党经济向高科技、私人消费驱动型增长的转变还远未完成,他预计中国经济增长将继续放缓,更深、更广、更持久。